Q3 2020 – Global Economic Overview

October 15th 2020 | , Urban Property Australia

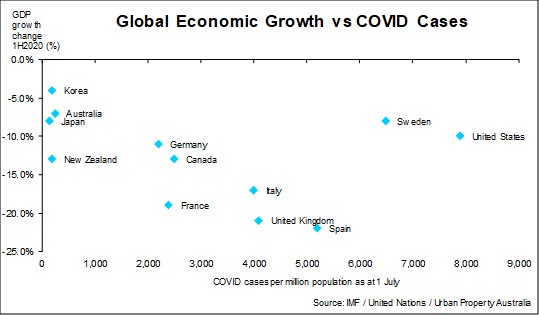

Australia’s economic and health outcomes compare favourably with those of most other countries. While Australia has lower COVID case numbers per capita and lower mortality rates than all the G7 nations with the exception of Japan. Australia has also outperformed in economic terms, with a smaller fall in GDP than every major advanced economy over the first half of 2020. Assuming the virus is effectively contained in Australia, economic activity is forecast to pick up from late 2020 and into early 2021.

Q3 2020 – Global Economic Overview

The economic effects of the COVID-19 pandemic have been severe. The spread of the virus and the restrictions implemented to contain it led to historic falls in economic activity and employment globally over the first half of 2020. Economic activity has contracted in almost every economy around the world. Most of Australia’s major trading partners experienced their most severe quarterly economic contraction on record in the June quarter 2020.

Major trading partner GDP is expected to fall by 3% in 2020, before growing by 5.75% in 2021. Eight of Australia’s top ten trading partners are expected to see a contraction in GDP in 2020, with China and Taiwan the exceptions.

Overall, global GDP is expected to fall by 4.5% in 2020. A recovery in the global economy will also support activity in Australia. The global economy is forecast to expand by 5% in 2021 due to some easing of containment measures and a gradual recovery in consumer and business confidence. However, economic activity in most major economies is forecast to remain below pre-pandemic levels until at least the end of 2021.

United States

In the United States, GDP is forecast to contract by 5.5% in 2020, before growing by 2.25% in 2021. Despite having the world’s highest count of confirmed COVID-19 cases and deaths, new infections have trended downward since July, following some parts of the country delaying or partly reversing moves to reopen. Unprecedented Government stimulus and Federal Reserve action have helped soften the pandemic’s impact on households and businesses to date. However, significant uncertainty remains around health and economic outcomes, which will continue to weigh on domestic demand.

China

The Chinese economy is forecast to grow by 1.75% in 2020 and 8.0% in 2021. Steady industrial production growth and the expected continued expansion of infrastructure and property investment will underpin its economic recovery over 2020. Over the remainder of the forecast period, China’s economy is expected to strengthen further, but a more moderate recovery in demand in the rest of the world, still cautious consumers and uncertainty about the health and economic outlook are expected to weigh on economic activity.

Europe

In the Euro area, GDP is forecast to fall by 9% in 2020 before partly recovering by 3.5% in 2021. As the Euro area emerged from strict lockdowns, early indicators pointed to a strong initial recovery on the back of pent up demand and the wide use of job support schemes. However, a significant increase in infections following the summer holiday period has seen the introduction of targeted, localised containment measures, which is expected to slow the recovery. A no deal Brexit remains a risk to the outlook for the euro area and the United Kingdom.

United Kingdom

The Bank of England has forecast the economic shock triggered by the coronavirus pandemic will be less than initially feared but the bounce-back will take longer and inflict lasting damage for jobs and growth. The Bank estimates that Britain’s economy will contract by 9.5% in 2020 before rebounding by 9.0% in 2021. The Bank of England projects the unemployment rate will double to 7.5% – about 2.5 million people – before the end of the year, and would remain above pre-pandemic levels until 2023.

India

India’s GDP is expected to fall by 9.0% in 2020, followed by growth of 9.0% in 2021. The sharp contraction in growth over the June quarter 2020 was driven by a nationwide lockdown that led to a significant weakening in domestic demand, severe supply chain disruption and labour market dislocation. Despite rising infection rates, India is now easing restrictions on a state by state basis. While this has brought about some recovery in activity, the strength and longevity of growth will depend on confidence and financial sector resilience, as well as whether the state and central governments can avoid further lockdowns. A weaker global outlook will also weigh on growth.

Copyright © 2020 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.