Q3 2021 – Australian Economic Overview

October 26th 2021 | , Urban Property Australia

Recent outbreaks of the Delta variant across Australia, and the resulting lockdowns, have introduced a high degree of uncertainty to the outlook for the remainder of 2021. As a result of the lockdowns, activity contracted in the September quarter along with some job losses. With the restrictions now eased, the economy is forecast to rebound from this setback, as it has from previous lockdowns.

While the Delta strain has required a more measured reopening of the economy in affected areas than in the past, the Australian economy entered this challenging period in a strong position and fiscal policy is directly supporting households and businesses in the affected areas.

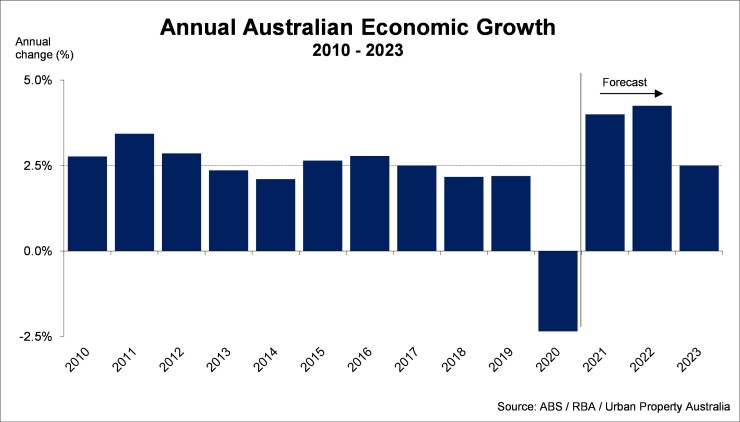

Australia’s economy is forecast to grow by 4.0% over 2021 (slightly lower than previous projections) and 4.25% over 2022. Beyond the near-term impact on activity from the lockdowns, the level of GDP is forecast to be a little higher in 2023 than was previously forecast.

Household spending was tracking strongly in the months prior to the recent lockdowns. However, household consumption contracted in the September quarter, accounting for most of the quarterly decline in GDP. Consumption is forecast to recover in affected areas across the December 2021 and March 2022 quarters.

Dwelling and business investment are forecast to boost activity over coming years. Recent lockdowns and temporary restrictions on construction activity in some states weighed on both residential and non-residential investment in the September quarter, but a rebound is anticipated in the December 2021 and March 2022 quarters with restrictions now eased.

Fiscal support and monetary easing over 2021 have underpinned a strong upswing in housing activity. Housing price growth and low interest rates are forecast to sustain a high level of construction of new houses and renovation activity over coming years. Investment in higher density residential construction is forecast to remain weak in the near term, reflecting the low level of building approvals over the past three years. However, as population growth gradually recovers, further declines in rental vacancy rates in larger cities are anticipated and this should support a pick-up in higher-density investment towards the end of the forecast period.

The robust recovery in non-mining business investment is forecast to continue, and the level of investment over coming years is forecast to be higher than previously projected. Machinery and equipment investment has increased strongly through 2021, supported by tax incentives, high levels of business confidence, a decline in spare capacity and strong business balance sheets. The forecast recovery in non- residential construction investment has been further delayed by recent restrictions, to the end of the year. The level of non-residential building approvals has edged higher over recent months, from a subdued level, providing some support for an eventual pick-up in construction activity.

Mining investment is forecast to increase over coming years, continuing the steady growth seen since 2019. This partly reflects firms undertaking investment to sustain their level of production, rather than to expand capacity in response to higher commodity prices.

Labour market conditions have improved more quickly than expected in recent months. The unemployment rate fell to 4.9% in June which it had not been forecast to reach until late this year. The recent activity restrictions will see some reversal in the near term, however longer term, the unemployment rate is forecast to decline steadily to around 4.25% by the end of 2022 and 4.0% by the end of 2023.

With most restrictions now lifted, the underlying strength in economic conditions (including high levels of job vacancies) should see the recovery in the labour market regain momentum towards the end of the year and into the first half of 2022. Beyond this, further improvements in the labour market are forecast to occur but at a more moderate pace, in line with the expected profile for activity.

Government spending has continued to increase through 2021 to date and should continue to contribute to GDP growth significantly over the next three years. The higher level of public consumption expected is based on additional spending announced in this year’s federal and state government budgets. Public investment growth is forecast to strengthen over 2021, albeit a little more slowly than previously projected with recent government budgets indicating that public investment would be rolled out more slowly.

At its most recent monetary policy meeting, the Reserve Bank of Australia decided to keep the cash rate unchanged at the all-time low of 0.10%. It also left the target for three-year government bond yields at around 0.10% and stated it will continue purchasing government bonds at the rate of AUD 4 billion a week until at least mid-February 2022 in order to maintain accommodative financing conditions.

The decision was underpinned by the will to support the recovery, following a likely downturn due to the Delta outbreak and the associated reinstatement of containment measures. Moreover, the RBA judged that wage and price pressures were still subdued.

The RBA maintained a dovish stance in its communication, stating that it is “committed to maintaining highly supportive monetary conditions to achieve a return to full employment”. Moreover, it ruled out hiking the cash rate before inflation establishes itself within the 2.0%–3.0% target range sustainably, which it does not expect to happen before 2024.

Copyright © 2021 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.