Q3 2021 – Melbourne Industrial Market

October 26th 2021 | , Urban Property Australia

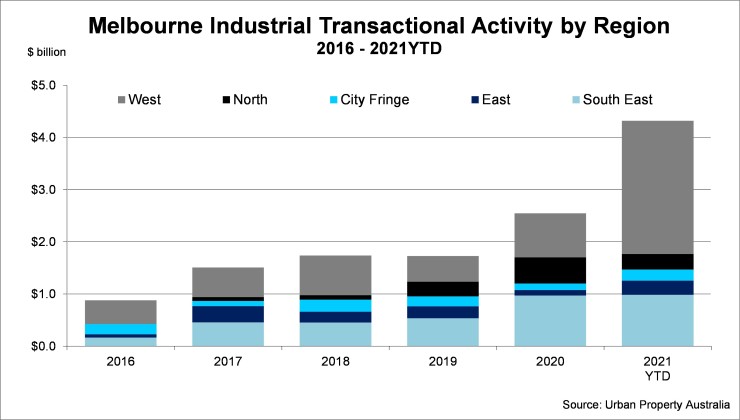

- Across Melbourne’s industrial market, more than $4.3 billion was transacted, already exceeding the previous record annul level of $2.5 billion;

- Investor demand for industrial assets has been underpinned with the pandemic driving faster take up of e-commerce and online retail penetration, has driven yields to historic lows;

- Vacant industrial space across the Melbourne market decreased through the 12 months to September 2021, as tenant demand outpaced supply, falling to all-time lows of sub-2%.

Industrial Market Summary

Boosted by a number of large portfolio sales, more than $4.3 billion has been transacted in the Melbourne industrial market in 2021 to date, already exceeding the previous record annul level of $2.5 billion. With the share of online retail reaching all-time highs and increasing demand larger facilities to accommodate automated supply chain requirements the Melbourne industrial vacancy rates has fallen below 2%.

Sales Volume / Yields

Transactional activity in the Melbourne industrial market accelerated though 2021 with strong demand from all investor types. Boosted by a number of large portfolio sales, Urban Property recorded more than $4.3 billion was transacted in the sector in 2021 to date. Indeed, the level of sales has already exceeded the previous record annul level of $2.5 billion achieved in 2020. In 2021 to date, transactional activity in the Melbourne industrial market was focused on the key precincts of the West and South East which collectively accounted for 82% of total sales. Influenced by the major portfolio transactions, offshore purchasers have accounted for 61% of the volume of industrial sales in 2021 to date, their highest share of industrial property sales in Melbourne in 10 years.

Yields have continued to compress as investors seek to increase their exposure to the sector underpinned by the ongoing growth of e-commerce. Average prime yields have compressed by 40 basis points over the 12 months to September 2021 with portfolio sales setting new benchmarks for the sector. While funding costs remain low and rental growth becomes more pronounced, Urban Property Australia anticipates that yields will compress further as investors aggressively seek investment opportunities.

New Supply / Land Values

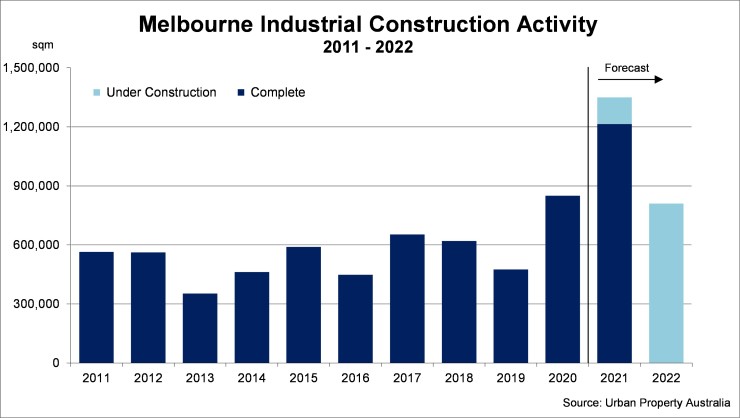

Following the decade-high of new supply last year, another 1,200,000sqm of industrial stock is scheduled to be completed in 2021, another decade high. Even with the highlighted level of construction, new supply is struggling to meet the robust demand from occupiers with 72% of new supply pre-committed and 60% of speculative stock already leased. The bulk of the new stock expected to be completed this year is located in the Western and South Eastern regions.

Declining land supply coupled with elevated tenant demand is placing upward pressure on land values as owner occupiers compete with institutional owners. Average industrial land values have increased by 15% through 2021 to date. The scarcity of developable industrial land and improving business outlook is likely to led to further land value growth.

Tenant Demand

The growing penetration of e-commerce has resulted in a significant lift in tenant demand through 2021. Retailers and wholesale trade boosted by the lift in non-discretionary spending have led tenant demand followed by logistics occupiers with leasing activity above the long-term average. The focus of the tenant demand has been on the Western and South Eastern regions which collectively accounted for 65% of gross take-up according to Urban Property Australia research.

Vacancy / Rents

Vacant industrial space across the Melbourne market decreased through the 12 months to September 2021, as the growth of e-commerce has driven tenant demand outpacing new supply. Urban Property Australia research estimates that Melbourne industrial vacancy rate currently stands at 1.5% as at October 2021 with the South East vacancy rate below 1%.

Rental growth gained momentum across all precincts in the Melbourne industrial market in the year to September 2021, coupled with a decrease in incentives levels from landlords. The underlying strength in the retail trade and logistics demand is contributing to a rise in leasing activity with strong demand for larger facilities to accommodate automated supply chain requirements. Urban Property Australia expects that this unsatisfied demand is likely to see rental growth rates improve over the next 12 months particularly in the South East which is expected to outperform given the lack of leasing options.

Copyright © 2021 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.