Q3 2021 – Melbourne Office Market

October 26th 2021 | , Urban Property Australia

- Sales activity in Melbourne’s metropolitan office market has surged in the second half of 2021 with more than $1 billion transacted in 2021 to date, almost doubling its long-term average;

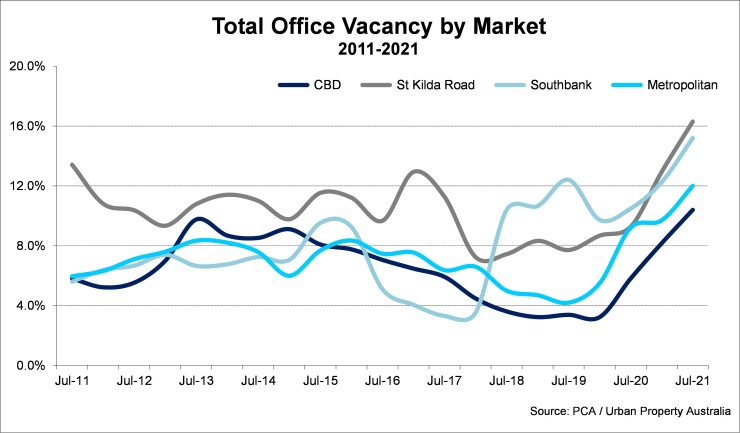

- The vacancy rate of the Metropolitan office market has risen to 15-year highs having been adversely impacted by the wave of new supply and subdued tenant demand;

- The total Melbourne CBD office vacancy has continued to increase through 2021 with its current rate at its highest level since the late 1990s.

Office Market Summary

Sales activity in Melbourne’s metropolitan office market has surged in the second half of 2021 with more than $1 billion transacted in 2021 to date, almost doubling its long-term average. Domestic institutions have increased their exposure to the metropolitan market having dominated transactions, accounting for almost 80% of office volume transacted in 2021 to date. Elsewhere, the total Melbourne CBD office vacancy has continued to increase through 2021 with its current rate at its highest level since the late 1990s.

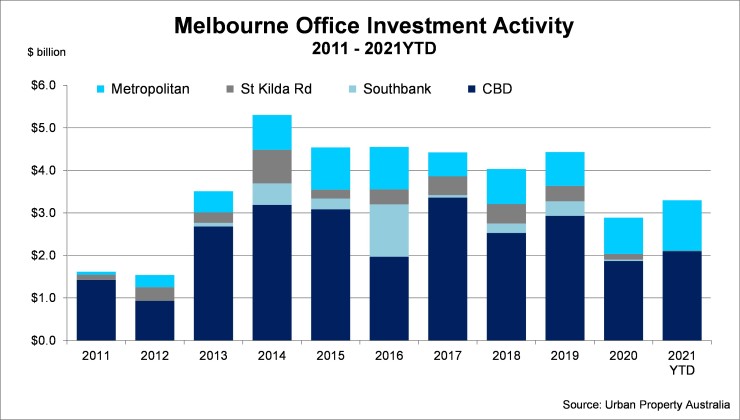

Sales Volume/Yields

Sales activity in Melbourne’s metropolitan office market has surged in the second half of 2021 with more than $1 billion transacted in 2021 to date. In comparison, $850 million was transacted in the full calendar year of 2020 and the level of sales activity in 2021 to date is already 30% above the long-term annual average of the market. Boosted by a number of major transactions, Urban Property Australia analysis has revealed that A-REITs have expanded their exposure to Melbourne’s metropolitan office market having accounted for almost 80% of office volume transacted in 2021 to date, their highest proportion in the market since 2011. Across the Melbourne metropolitan office market four transactions exceeded $150 million as institutions sought to increase their exposure to the sector.

Adversely impacted reduction of tenant demand and potentially a structural change of working styles, investor caution has led to a marginal easing in office yields over the 12 months to September 2021. Having fallen to historical lows in late-2020, prime metropolitan office yields eased to average 5.8% with secondary yields decompressing to 7.0%. While Urban Property expects investor interest for prime assets with solid income profiles to remain robust, the yield spread between secondary assets is likely to continue to widen as investors become more discerning.

Supply

New supply in the Melbourne metropolitan office market is projected to be above its long-term average in 2021 with more than 200,000sqm scheduled for completed across a range of speculative and pre-committed developments. Like the trends observed in recent years, the City Fringe precinct accounts for the majority of new supply projected to be completed in the metropolitan office market in 2021. Beyond 2021, Urban Property is currently tracking a further 90,000sqm of new office projects currently under construction. Of all the total stock currently under construction in the metropolitan office market, 48% is already committed. The amount of uncommitted stock in the developments under construction is likely to put further upward pressure of the vacancy rate of the Melbourne metropolitan office market over the next two years. Looking ahead, UPA expects that new supply in the metropolitan office market has peaked for the medium term with tenants cautious to commit to new leases in the current environment.

Tenant Demand

With the Victorian economy the hardest hit hardest by the pandemic, Victoria’s total employment has only just surpassed pre-COVID levels having lost approximately 240,000 jobs at the height of the virus. Reflecting the employment growth of Victoria, the State’s unemployment rate has fallen to 4.8% as at September 2021, down from 6.7% as at September 2020. Highlighting the growing business investment environment, as at August 2021, there were 58,600 jobs being advertised compared with only 25,900 in August 2020. Mirroring the employment growth, tenant enquiries and leasing activity has also improved through 2021.

Vacancy/Rents

Unfavourably impacted by the record levels of completions and subdued tenant demand, the vacancy rate of the Melbourne metropolitan office market increased to 12% as at July 2021, its highest level in 15 years. Urban Property forecast that the vacancy rate of the metropolitan office market will continue to peak at the end of 2021 before stabilising in 2022 as the pipeline of new supply begins to dissipate.

Reflecting the elevated vacancy levels and modest leasing activity across the Melbourne metropolitan office market, prime rents have declined for the first time in five years. Metropolitan office rents have been affected by both a fall in net face rental levels and an increase in incentive levels. Looking ahead, Urban Property Australia forecasts that prime rents will continue to soften as tenants reassess their office requirements. Secondary office rents are projected to decline even more as occupiers seek to capitalise on better quality space which is being currently demonstrated from enquiries.

CBD, St Kilda Road & Southbank Office Markets

The total Melbourne CBD office vacancy has continued to increase through 2021 to 10.4% as at July 2021, its highest level in more than 20 years. The pandemic has also resulted in a surge of sub-lease space in the CBD with more than 400,000sqm anecdotally being currently being marketed, significantly higher than the “official” Property Council. The level of sub-lease vacancy is likely to remain elevated as businesses reconsider their office space needs with subdued business outlook and decisions to reduce staff numbers with the conclusion of the JobKeeper program. The impact of the pandemic has also resulted in prime CBD office net effective rents which have declined back to their lowest levels in three years. Urban Property Australia forecasts that prime CBD office net effective rents will decline further through 2021 as employees and businesses remain wary of CBD-based office space.

Outside of the CBD, the vacancy rate of both the St Kilda Road and Southbank office markets rose as tenants contracted and relocated to other markets. As at July 2021, St Kilda Road’s office vacancy rate (16.3%) has risen to its highest rate since 2000 while Southbank’s office vacancy rate (15.2%) rose it is highest rate since 2005. Similar to the CBD, both the St Kilda Road and Southbank office markets recorded an increase in sub-lease vacancy. Although the vacancy rates of both the St Kilda Road and Southbank’s office markets are elevated; Urban Property Australia anticipates the addition the Anzac railway station in 2025 and the rejuvenation project of Southbank Boulevard will stimulate tenant demand for both markets in the medium term. Sales activity in both Southbank and St Kilda Road office markets was limited in 2021 with only one asset having transacted across both precincts in the year to date.

Copyright © 2021 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.