Q3 2022 – Global Economic Outlook

November 7th 2022 | , Urban Property Australia

- High inflation resulting from the after-effects of the pandemic and disruptions to global energy supply stemming from Russia’s invasion is proving a more formidable challenge to global growth than previously forecast;

- Impacted by high inflation, rising interest rates and recent flooding Australia’s economy is forecast to slow;

- Victoria’s economy rebounded strongly through 2022 and its economic outlook for 2023 remains positive, although growth will be tempered by the effect of rising interest rates and a weaker global economic outlook.

Economic Summary

The risk of recession across major advanced economies has risen and China’s growth outlook has weakened. Australia has withstood the pandemic and recovered solidly, but Australia is not immune to the global challenges driving higher global inflation and slower global growth. While Australia’s economic growth is forecast to slow, unemployment is expected to stay around historic lows. Recent flooding across eastern states are expected to weigh on both exports and investment over coming quarters and are likely to add to inflation which also may increase downward risks to Australia’s outlook.

Q3 2022 – Global Economic Overview

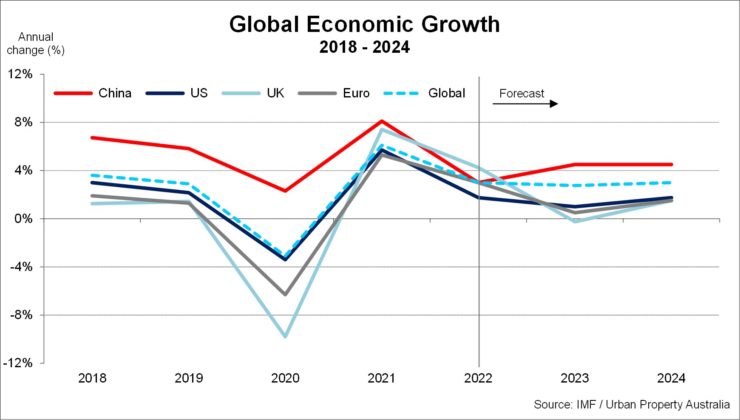

The global economic environment has sharply deteriorated. High inflation is sapping momentum and global growth is slowing by more than expected, with some major economies stalling or contracting. Higher global interest rates have increased the risk of recession across all major advanced economies, and the outlook for China has weakened.

The global recovery from the pandemic has continued to face disruptions and significant shocks, most notably from the Russian invasion of Ukraine driving up food and energy prices, and the impact of continued COVID 19 lockdowns in China.

High inflation resulting from the after-effects of the pandemic and disruptions to global energy supply stemming from Russia’s invasion is proving a more formidable challenge to global growth than previously forecast.

Central banks have signaled that tighter monetary policy will be necessary to return inflation to levels consistent with their targets. The combination of higher inflation and higher interest rates is expected to see a significant slowing in household demand. Labour markets remain tight with unemployment rates at or below pre pandemic levels across advanced economies.

The global growth forecast has been downgraded through 2022 with global economic growth is now expected to slow to 3.0% in 2022 and 2.75% in 2023, before picking up in 2024.

United States

The United States economy is forecast to grow by 1.75% in 2022, 1.0% in 2023, and 1.7% in 2024. This is well below the average growth rate over the past two decades. Despite recent solid momentum in consumer spending and employment, growth prospects have deteriorated significantly as a result of the increased pace of monetary policy tightening in response to stubbornly high inflation. Inflation is expected to moderate slowly in 2023 as pandemic related supply and demand imbalances resolve and tighter monetary policy takes effect. Growth is expected to slow significantly in 2023, with unemployment to rise, though the US is expected to avoid a deep recession.

China

China’s economy is forecast to grow by 3.0% in 2022, and 4.5% in 2023 and 2024. Outbreaks of COVID 19 between March and May 2022 prompted large lockdowns that severely affected economic growth. Authorities are now more sensitive to small outbreaks, locking down quickly and frequently, which has created uncertainty for consumers. With authorities likely to maintain their approach to COVID 19 for an extended period, Chinese consumer spending is likely to remain weak over coming years. In contrast to the sharp tightening in monetary policy elsewhere, Chinese authorities are easing macroeconomic policy settings to support a slowing economy. Elevated government spending on infrastructure may support growth this year.

Europe

The Euro area economy is forecast to grow by 3.0% 2022, 0.5% in 2023 and 1.5% in 2024. Growth has been strong so far in 2022 as the Euro area continues to recover from the effects of the pandemic. The pronounced slowing in growth next year is the result of rising energy and food prices stemming from Russia’s invasion of Ukraine. Inflation will weigh on real household incomes and spending, although fiscal support is anticipated to somewhat soften its overall impact. The war in Ukraine continues to exacerbate these concerns and the prospect of further energy supply or price shocks, places the Euro area at high risk of recession.

United Kingdom

While the economy grew strongly in the first quarter of 2022, growth is expected to slow sharply, and the inflation outlook has deteriorated dramatically due to higher gas prices and increasing domestic inflationary pressures. The United Kingdom’s economy is forecast to grow by 4.25% in 2022, then contract by 0.25% in 2023 before growing by 1.5% in 2024. However, uncertainty around the outlook is exceptionally high given the unknown size, structure and impact of the Government’s yet to be legislated fiscal package. The package aims to limit increases in household energy bills in the near term and boost investment in the longer term.

India

India’s economy is forecast to grow by 7.25% in 2022, followed by 5.75% in 2023 and 6.75% in 2024. A strong recovery in domestic demand with contact intensive services opening faster than expected, coupled with strong government spending is expected to drive growth. However, stubbornly high inflation, rising interest rates and weaker activity in the US and Europe pose key risks to growth.

Copyright © 2022 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.