Q3 2023 – Melbourne Retail Market

November 13th 2023 | , Urban Property Australia

- Total transactions in the Melbourne retail property market recorded in 2023 so far has exceeded $1.4 billion, already surpassing the annual volume of retail property sales recorded last year;

- While retail trade in Victoria continues to outperform the national average the annual increase in sales has eased through 2023 as consumer confidence has weaken by increased cost of living;

- Online retail trade in Australia continues to gradually take a larger share of overall spending, making up 10% of total retail sales with $45 billion spent online over the past 12 months.

Retail Market Summary

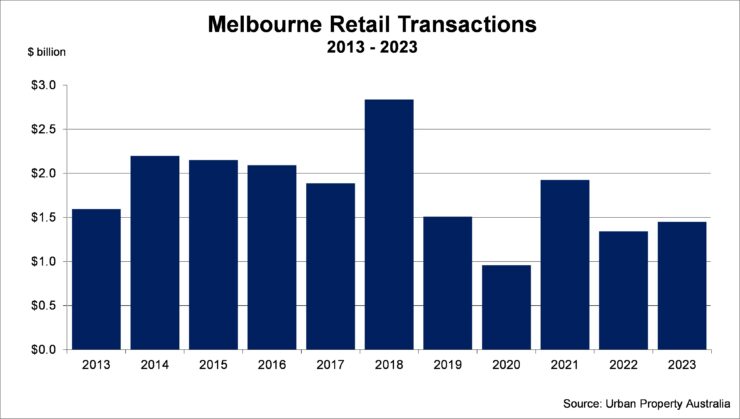

Total transactions in the Melbourne retail property market recorded in 2023 so far has exceeded $1.4 billion, having been boosted by a number of major sales, already surpassing annual volume of retail property sales recorded last year, $1.3 billion. While retail trade in Victoria continues to outperform the national average the annual increase in sales has eased through 2023 as consumer confidence weakens and the increased cost of living has adversely impacted retail trade. Across most retail categories, sales growth recorded in 2023 is below that achieved in the preceding 12 months.

Sales Volume / Yields

Urban Property Australia research has revealed that total transactions in the Melbourne retail property market in the 2023 to date have totalled more than $1.4 billion, having been boosted by a number of major sales, already surpassing the whole annual total of $1.3 billion recorded in 2022. Impacted by rising interest rates and higher borrowing costs, yields have softened across assets in the 12 months to September 2023. Urban Property Australia expects yields of retail assets will expand further over the next six months in line with increased borrowing costs and slowing retail turnover conditions.

Demand

While retail trade in Victoria continues to outperform the national average the annual increase in sales has eased through 2023 as consumer confidence weakens and the increased cost of living has adversely impacted retail trade. Over the year to September 2023, annual retail trade in Victoria grew by 5.5%, close to the 10-year average of 5.3%. In comparison, Australian annual retail trade grew by 5.2% over the year to September 2023. Victoria has now outperformed the national average since September 2021.

Across most retail categories, sales growth recorded in 2023 is below that achieved in the preceding 12 months with electrical, home hardware and recreational retail sectors actually recording sales contractions. Food retail sales continue to increase as does fashion retail trade and interestingly turnover in cafes and restaurants.

Online retail trade in Australia continues to gradually take a larger share of overall spending. According to the ABS, as at September 2023, online sales made up 11% of total retail sales with Australian online sales with Australian consumers spending approximately $45 billion online over the past 12 months.

Retail Strips

Total vacancy of Melbourne’s prime retail strips has fallen from its all-time highs with around 12% of all shops vacant. The vacancy levels of Fitzroy Street, St Kilda is the highest at 28% with elevated vacancy rates at Chapel Street, South Yarra (12%), Glenferrie Road, Malvern (15%) and Lygon Street, Carlton (13%), albeit there is some gradual improvement in the latter.

The food and beverage sector increased its presence across the strips, growing in the majority of the precincts however a number of fashion retailers have vacated the prominent strips, impacted by store rationalisation and the growing influence of e-commerce.

With many strips having been re-discovered by locals now working from home, some retailers have successfully adjusted to the changing consumer trends. The elevated vacancy levels and rationalisation of some retailers has resulted in rental levels easing with some landlords also offering flexible lease terms and incentives to attract new occupiers.

The retail sector has improved at a remarkable pace and well beyond any forecasts. Now that more normalised spending patterns have emerged and if the economic recovery continues to gather pace, looking forward, Urban Property Australia expect to see a stabilisation of service-based consumption and a shift towards goods-based consumption moving forward which will benefit the retail strips markets.

Copyright © 2023 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.