Q4 2021 – Global Economic Overview

January 26th 2022 | , Urban Property Australia

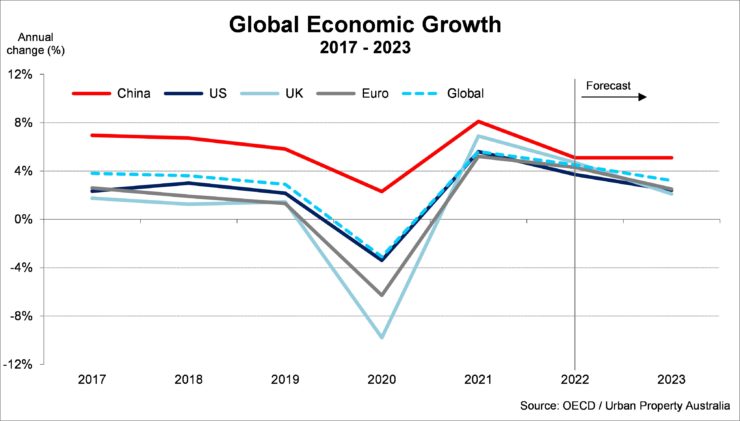

The global recovery continues to progress but has lost momentum and is becoming increasingly imbalanced with economic growth of 4.5% forecast in 2022, down from the previous year; The Australian economy is rebounding strongly, underpinned by Australia’s high vaccination rate and effective policy support; While the Victorian economy continues to recover, the current period of low population growth will have an enduring effect on the Victorian economy.

Economic Summary

The pandemic will continue to pose headwinds for the global and domestic recovery for some time to come, as demonstrated by the recent emergence of the Omicron variant. However, Australia’s high vaccination rate and increased investment in health system capacity, together with ongoing improvements in vaccines, are likely to assist in mitigating the downside risks to the economic outlook. The Australia’s economy is forecast to grow by 4.1% in 2022 and by 3.0% in 2023.

Q4 2021 – Global Economic Overview

The global recovery continues to progress but has lost momentum and is becoming increasingly imbalanced. Parts of the global economy are rebounding quickly but others are at risk of being left behind, particularly lower-income countries where vaccination rates are low.

Momentum from the strong rebound after reopening is now easing in many countries amidst persisting supply bottlenecks, rising input costs and the continued effects of the pandemic.

Enhanced global vaccination efforts, which are assumed to allow a full withdrawal of restrictions on cross-border activities by the end of 2022, supportive macroeconomic policies, accommodative financial conditions, and lower household saving should all enhance demand and offset headwinds from the gradual unwinding of pandemic-related fiscal measures.

According to the OECD, the global recovery is projected to continue but with global GDP growth moderating over time, with global growth easing from 5.6% in 2021 to 4.5% in 2022 and 3.25% in 2023. Most advanced economies are projected to return to their pre-pandemic output path by 2023, but with greater debt and still-subdued underlying growth potential.

Significant risks remain around these projections. New, more transmissible COVID-19 variants such as the omicron variant may continue to appear, especially if the speed of vaccine deployment and the effectiveness of existing vaccines wane, hitting growth prospects.

United States

The Omicron variant has led to the rapid spread of COVID throughout the United States and is weighing on economic growth at the start of the year. This variant appears to result in fewer serious complications, but still requires large numbers of workers to isolate themselves for a few days. The spike in COVID cases is worsening labour shortages and has adversely impacted supply. Economic engagement has been less affected than employment but has still moderated across much of the US. The OECD now forecasts the US economy to increase by 5.6% this year, down from previous projections.

China

The spread of new variants amid large inequalities in vaccination rates, elevated food and commodity prices will weigh on China’s outlook in 2022, by dampening export performance, a key growth driver last year. In addition, the broad-based slowdown in the property sector, which accounts for at least 20% of China’s overall economic activity, is expected to continue, with more cities seeing home prices falling. Following a strong 8% rebound in 2021, the World Bank expects economic growth in China to slow to 5.1% in 2022, which would mark the third-slowest growth year since the late 1970s.

Europe

After a strong rebound in 2021 with GDP growth of 5.2%, as confinement measures were gradually lifted, economic activity in the Euro area is projected to expand by 4.3% in 2022 and 2.5% in 2023. The recovery is being hampered by shortages of key manufacturing inputs, although a large stock of unfilled orders signals a strong potential rebound as supply constraints ease. Looking ahead; economic growth will be supported by strong consumption, with households reducing their saving rate, and higher investments owing in part to national and European recovery plans. Unemployment is projected to decline to close to pre-crisis levels.

United Kingdom

A fast initial roll-out of COVID-19 vaccines has weakened the link between new COVID-19 cases, hospitalisations and deaths, allowing a broad reopening of the economy. The economy is recovering and expected to reach pre-crisis levels early 2022. The OECD is forecasting that the UK’s economy will grow by 4.7% in 2022 before moderating to 2.1% in 2023. Consumption is the main driver of growth while business investment will continue to improve but continues to be held back by uncertainty. Increased border costs following the exit from the EU Single Market also continues to weigh on imports and exports.

India

Prospects of an economic rebound in India are firming up as GDP is set to expand by 9.4% in 2022 and 8.1% in 2023, before moderating to 5.5% 2024. Activity is supported by the increasing pace of vaccination, which is boosting consumers’ sentiment, and the inflation slowdown, which protects purchasing power. Despite the economic recovery, GDP is still far from the pre-crisis levels. The appearance of a new virus variant, especially if combined with a relaxation of attitudes, is the major downside risk, together with a less supportive global economic and financial environment.

Copyright © 2022 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.