Q4 2021 – Melbourne Retail Market

January 26th 2022 | , Urban Property Australia

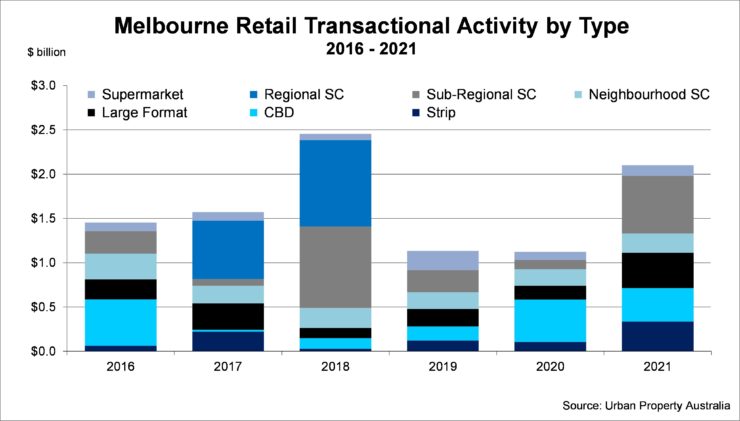

Investment activity in the Victorian retail property sector surpassed $2 billion in 2021, 25% above the five-year average;

Over the year to November 2021, annual retail trade in Victoria grew by 8.2%, more than double the 10-year average;

Online retail trade in Australia continues to gradually take a larger share of overall spending with $41 billion spent, an all-time high.

Retail Market Summary

Investment activity in the Victorian retail property sector surpassed $2 billion in 2021. Sales volume was boosted by a number of sales of Sub-Regional shopping centres. Domestic private investors were active in the Melbourne retail property market, accounting for 38% of retail stock sold in the year. Yields were relatively stable across the retail sector as investors were prudent in order to assess retail trends beyond COVID.

Sales Volume/Yields

Urban Property Australia research has revealed that total transactions in the Melbourne retail property market reached $2.1 billion in 2021, its highest level since 2018. Sales volume in 2021 was boosted by a number of sales of Sub-Regional shopping centres. With Sub-Regional shopping centre transactional volume totalling $650 million over the year, the classification accounted for 30% of total retail property sales. Underpinned by strong private investor activity, the volume of retail assets in retail strips totalled $335 million, accounting for 16% of the Melbourne retail property transactional volume. Over 2021, Urban Property Australia research revealed that domestic REITS, unlisted funds and syndicates accounted for 43% of the volume of Victorian retail property. Offshore groups purchased 19% of retail property assets sold this year. Domestic private investors accounted for 38% of retail properties sold in 2021.

Yields have stabilised for the majority of retail asset types over 2021 as investors remained cautious in the uncertainty of the behaviour of consumers post-pandemic. Over 2021, yields of Neighbourhood shopping centres have tightened as investors focused on non-discretionary spending in assets located in residential hubs. Yields for Regional shopping centres and large format assets remained steady having expanded through 2020.

Demand

The Australian retail sector has been buoyed by the effective management of the pandemic and a beneficiary of the largest stimulus package in Australian history. Households are spending their savings accumulated during the COVID-19 period, and retail trade is increasing. Furthermore, with many residents remaining hesitant of offshore travel, a potential $60 billion per annum normally spent by Australians on overseas travel is likely to be spent domestically. Continued spending by Australians and further support from the Federal Government on job creation will continue to drive the recovery in the retail sector.

Over the year to November 2021, annual retail trade in Victoria grew by 8.2%, more than double the 10-year trade average of 3.7%. In comparison, Australian annual retail trade grew by 6.0% as at November 2021, also double its 10-year average as consumers spent more with many shops re-opening.

Although retail trade grew in Victoria has recovered through 2021, the variance of the performance of the individual retail sub-sectors illustrates the impact of the pandemic with retail trade for cafes and restaurants 47% higher than levels last year whereas retail trade for supermarkets increased by 0.1%.

Online retail trade in Australia continues to gradually take a larger share of overall spending. According to the ABS, as at November 2021, online sales made up 12% of total retail sales with Australian online sales with Australian consumers spending approximately $41 billion online over the past 12 months.

Retail Strips

Total vacancy of Melbourne’s prime retail strips has risen to all-time highs with around 12% of all shops vacant. The vacancy levels of Bridge Road, Richmond is the highest at 20% with elevated vacancy rates at Chapel Street, South Yarra (19%), Fitzroy Street, St Kilda (13%) and Lygon Street, Carlton (20%).

The food and beverage sector increased its presence across the strips, growing in the majority of the precincts however a number of fashion retailers have vacated the prominent strips, impacted by store rationalisation and the growing influence of e-commerce.

With many strips having been re-discovered by locals now working from home, some retailers have successfully adjusted to the changing consumer trends. The elevated vacancy levels and rationalisation of some retailers has resulted in rental levels easing with some landlords also offering flexible lease terms and incentives to attract new occupiers.

The retail sector has improved at a remarkable pace and well beyond any forecasts. When looking at spending patterns of discretionary versus non-discretionary goods, the onset of COVID-19 drove the panic buying of food and beverage items and a hiatus in non-discretionary spending due to the lockdown period and resultant store closures. Consequently, non-discretionary spending declined whereas discretionary spending has increased. Now that more normalised spending patterns have emerged and if the economic recovery continues to gather pace, looking forward, Urban Property Australia expect to see a stabilisation of service-based consumption and a shift towards goods-based consumption moving forward which will benefit the retail strips markets.

Copyright © 2022 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.