Q4 2022 – Global Economic Overview

February 10th 2023 | , Urban Property Australia

- The rise in central bank rates to fight inflation and Russia’s war in Ukraine continue to weigh on economic activity with the global economy projected to increase by 2.9% this year, lower than growth achieved last year;

- While Australia’s economy has been driven in recent years by household consumption, it is expected to slow considerably as pressures on household budgets begin to mount with rising interest rates;

- Victoria’s economic outlook for 2023 remains positive, although growth will be tempered by the effect of rising interest rates and a weaker global economic outlook.

Economic Summary

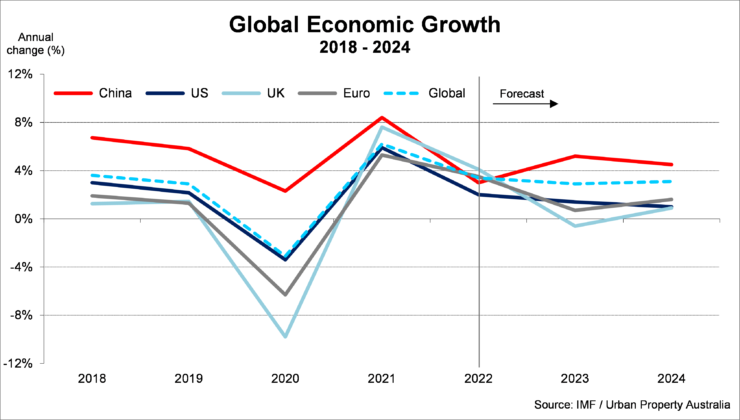

The global economy is projected to increase by 2.9% this year, lower than growth achieved last year and previous forecasts. The forecast of low growth in 2023 reflects the rise in central bank rates to fight inflation, especially in advanced economies, as well as the war in Ukraine. Global economic growth is forecast to rise to 3.1% in 2024, although still below the 20-year historical average of 3.8%. Growth is expected to pick up boosted by the full reopening of China this year and the reflects the gradual recovery from the effects of the war in Ukraine and subsiding inflation.

Q4 2022 – Global Economic Overview

The global economy is projected to increase by 2.9% this year, lower than growth achieved last year and previous forecasts. The forecast of low growth in 2023 reflects the rise in central bank rates to fight inflation, especially in advanced economies, as well as the war in Ukraine.

Global economic growth is forecast to rise to 3.1% in 2024, although still below the 20-year historical average of 3.8%. Growth is expected to pick up boosted by the full reopening of China this year and the reflects the gradual recovery from the effects of the war in Ukraine and subsiding inflation.

Around 84% of countries are expected to have lower headline (consumer price index) inflation in 2023 than in 2022. Global inflation is set to fall from 8.8% in 2022 (annual average) to 6.6% in 2023 and 4.3% in 2024 – above pre-pandemic (2017–19) levels of about 3.5%. The projected disinflation partly reflects declining international fuel and nonfuel commodity prices due to weaker global demand.

These forecasts are based on a number of assumptions, including on fuel and non-fuel commodity prices, which have generally been revised down since October, and on interest rates, which have been revised up. In 2023, oil prices are projected to fall by 16%, while non-fuel commodity prices are expected to fall by, on average, 6.3%.

United States

The United States economy is forecast to grow by 1.4% in 2023 and 1.0% in 2024, with growth rebounding in the second half of 2024. This is well below the average growth rate over the past two decades. Economic growth has been revised up this year, reflecting the domestic demand resilience in 2022, however downward revisions have been made for 2024 due to the steeper path of Federal Reserve rate hikes, to a peak of about 5.1% this year. A weakening economy will likely warrant a reduction in rates in the second half of the year, with a shallow recession in the US in the next 12 months emerging as the most likely outcome.

China

China’s expected economic growth of 3% last year is the first time in more than 40 years with China’s growth below the global average. Economic growth in China is projected to rise to 5.2% in 2023, reflecting rapidly improving mobility, and to fall to 4.5% in 2024 before settling at below 4% over the medium term amid declining business dynamism and slow progress on structural reforms. While inflation is not a concern in China, the previous go-to government stimulus policies of boosting residential property and building infrastructure is likely to be stymied by the wider issues facing the real estate sector, creating additional uncertainty for 2023.

Europe

The growth outlook for the Euro area is bleak given the region’s energy ties to Russia against a backdrop of significant geopolitical tensions since Russia’s invasion of Ukraine. Inflation in the Euro area is at historical highs and is being driven primarily by energy prices which are some 40% higher than a year ago. Output is highly likely to dip during the winter months as higher energy requirements meet constrained supply. In early September, Russia drastically reduced the supply of gas to Europe sending projections for energy prices higher still. Economic growth in the Euro area is projected to bottom out at 0.7% this year before rising to 1.6% in 2024.

United Kingdom

Economic growth in the United Kingdom is projected to be –0.6% in 2023, a 0.9% downward revision from October 2022, reflecting tighter fiscal and monetary policies and financial conditions and still-high energy retail prices weighing on household budgets. The effect of Russia’s invasion of Ukraine and the subsequent reduction in gas supplies on electricity bills has been more significant in the UK, on average, than it has in Europe. This is because of the UK’s relatively faster pivot away from coal to natural gas. Approximately 40% of electricity generation in the UK is fuelled by natural gas. Beyond this year, the United Kingdom’s economy is forecast to grow by 0.9% in 2024.

India

The outlook is more positive in India than in most other economies around the world. However, economic output remains below the trend seen in the decade before the pandemic. Growth in India is set to decline from 6.8% percent in 2022 to 6.1% in 2023 before picking up to 6.8% in 2024, with resilient domestic demand despite external headwinds. The outlook beyond the near term is positive owing to strong consumer spending, especially in urban centres, which has, in turn, supported a robust expansion of activity in the services and manufacturing sectors.

Copyright © 2023 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.