Q4 2022 – Melbourne Residential Market

February 10th 2023 | , Urban Property Australia

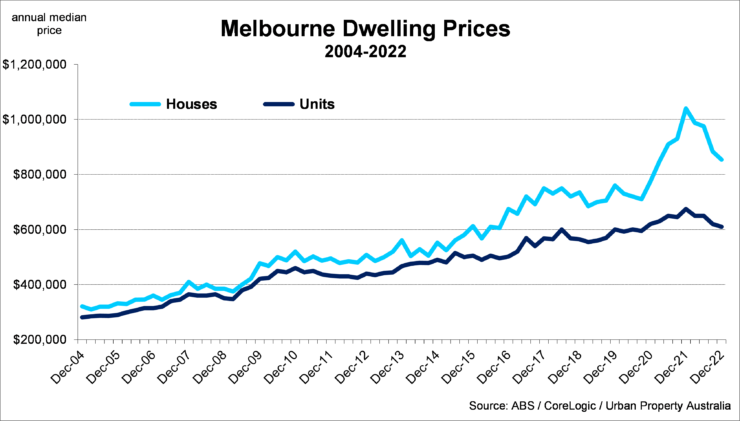

- Over the past 12 months, Melbourne’s house prices have now fallen at their greatest rate in 20 years while unit prices have fallen by their greatest level in 10 years;

- Vacancy rates have decreased across all Melbourne’s precincts over 2022 with the Outer region the tightest at 1.4%;

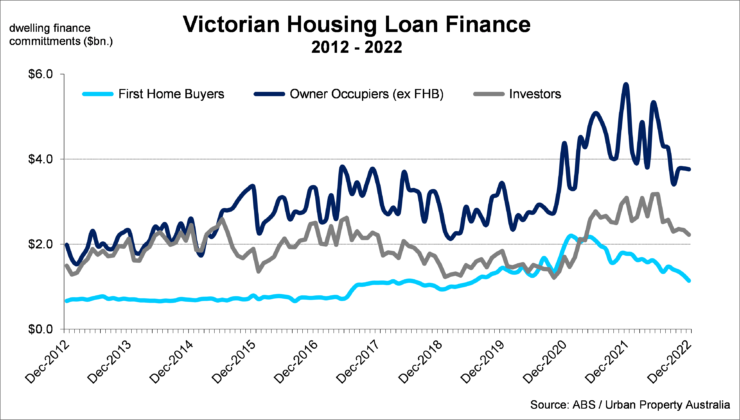

- While Victorian housing finance commitments sit 41% above the 10-year average, total levels have fallen by 6% over the past year with first home buyers down by 36% over 2022.

Residential Market Summary

Melbourne’s median house and unit prices have declined for four consecutive quarters with Melbourne’s median house prices having now fallen to their lowest levels since March 2021. While prices have decreased, the vacancy rate for Melbourne residential property fell to 2.5%, down from its peak of 6.5% of March 2021, and now sits below its 10-year average for the first time since the pandemic. Mirroring the improving vacancy trends, metropolitan residential rents for Melbourne houses across all precincts increased over the past year.

Prices

Although there is a variety of measurements and thus a difference in the level of annual change, it appears that there is a clear downward trend of Melbourne house prices according to a range of sources with the REIV reporting an annual decline of -13.4%, CoreLogic -10.8% and the ABS an annual decline of 17.7%. Looking ahead, while there is speculation that interest rates are close to peaking, further rises remain likely which will continue to adversely impact borrowing capacity for borrowers and maintain downward pressure on housing prices.

Having peaked in the December 2021 quarter, Melbourne’s median house and unit prices have declined for four consecutive quarters. With Melbourne’s median house prices now falling values are now 10.8% lower than their peak of December 2021.

Similar to the detached housing sector, Melbourne median unit prices have trended down over the past four quarters, decreasing to $610,000, 10% lower over the year. Melbourne’s median house prices have now fallen to their lowest levels since March 2021 while median unit prices have declined to levels last seen in September 2020. Melbourne’s house prices have now fallen at their greatest rate in 20 years while unit prices have fallen by their greatest level in 10 years.

Supply

According to the ABS, there are currently 71,800 dwellings under construction across Victoria, close to all-time high levels. The number of dwellings currently under construction is 16% above the 10-year average having increased by 8% over the year. The number of both houses and units under construction across Victoria are above their respective 10-year averages. Having fallen to six-year lows, the number of units under development continues to recover, albeit still below the peaks seen in 2019. Over the past year, Victoria’s population grew by 65,600 still 32% below the 10-year average of 96,800. While Victoria is still witnessing a net outflow of residents to other Australian states, overseas migration growth continue to recover. Further ahead, over 2022, a total of 61,800 dwellings were approved in Victoria, slightly below the 10-year average. While the share of unit developments is picking up, its proportion is rising as a result of the house approvals decreasing from their peaks of 2021 with levels down 22% over the year.

Demand

With Victoria’s population once again growing having contracted over 2020 and 2021, current total annual Victorian housing finance commitments sit 41% above the 10-year average in December 2022 with $99.6 billion financed, however have fallen by 6% over the past year. The elevated housing finance levels have been underpinned by owner occupiers with current levels sitting 20% above the 10-year average. Although first home buyers remain active in the market with current levels at 5% above their 10-year average, their finance levels have decreased by 36% over 2022. Similar to the owner occupier sector, investor finance has also softened over the December quarter, impacted by higher borrowing costs. While investor financing volumes have eased over the year, investors now account for 31% of total housing finance commitments in Victoria, compared to their share 25% two years ago. Looking ahead, with vacancies falling and rents continuing to recover, Urban Property Australia expects that investors will continue to grow their share of housing loans.

Vacancy

According to the REIV, as at December 2022, the vacancy rate for Melbourne residential property fell to 2.5%, down from its peak of 6.5% of March 2021, and now sits below the 10-year average of 3.1%, the first time since the pandemic. With the exception of the Middle Melbourne region, all precincts current vacancy rates now site below their respective 10-year averages. Vacancy rates have decreased across all Melbourne’s precincts over 2022 with the Outer region the tightest at 1.4%. The Middle Melbourne region holds the highest vacancy rate at 5% while the vacancy rate of the Inner region sits at 2.5%. Looking ahead, Urban Property Australia projects that the vacancy rate for the metropolitan Melbourne area will remain low with falling supply levels coupled with population growth of Melbourne’s continuing to recovery.

Rents

Mirroring the improving vacancy trends, according to the REIV, metropolitan residential rents across the precincts increased over the past year. Over 2022, the weekly median rent for houses in metropolitan Melbourne increased to $513 per week, up from $500 per week a year earlier. Across Melbourne, rents for houses located in the Middle region increased by 9.0%, with rents in the Outer region increasing by 7.0% and the rents in the Inner precinct rising by 2.2%. Interestingly, rents for Melbourne units increased by 9.5% over the year with unit rents rising across all precincts. Looking forward, Urban Property expects that residential rents will steadily increase as prospective buyers will have a lower borrowing capacity impacted by higher interest rates.

Copyright © 2023 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.