Q4 2022 – Victorian Economic Overview

February 10th 2023 | , Urban Property Australia

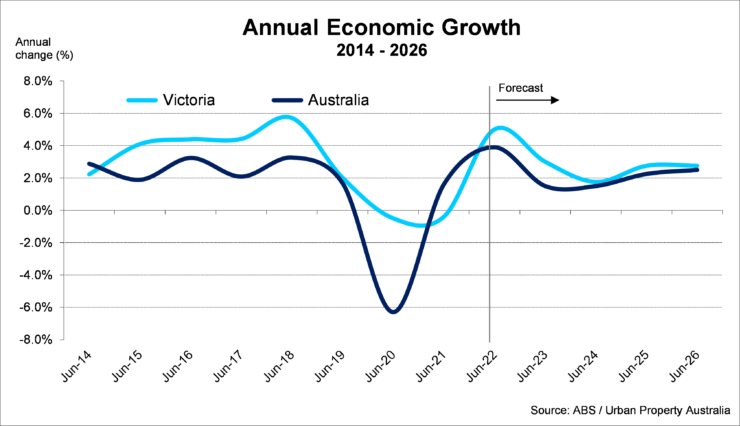

Victoria’s economy rebounded strongly as it recovered from the effects of the COVID-19 pandemic and is expected to record growth of 3.0% in 2023.

Although growth will be tempered by the effect of rising interest rates and a weaker global economic outlook business investment intentions are positive and forward indicators of labour demand, such as job advertisements and job vacancies, are strong. Activity will also be supported by a very high level of household savings, which is expected to help consumers remain resilient during a period of higher inflation and interest rates.

Victoria’s labour market has recovered well from the earlier effects of the COVID-19 pandemic and necessary public health restrictions. Since its trough in September 2020, employment has risen by 370,500 persons. The unemployment rate has declined sharply over the past year, falling to 3.5% near a 50-year low.

Labour market conditions are expected to remain strong this year, consistent with leading indicators of labour demand, such as job advertisements and job vacancies, which remain very high. Softening economic conditions are expected to weigh on employment growth somewhat in the medium term. Employment is forecast to grow by 1.75% this year and 1.0% in 2024. The unemployment rate is forecast to average 3.75% this year, before gradually rising in line with slower economic growth.

The rebound in household spending is expected to continue this year, as spending – notably on consumer services – continues to recover from pandemic-related disruptions. The labour market remains strong and will support household incomes. Elevated levels of household savings, which have been accumulated during the pandemic, are also expected to support ongoing household consumption.

Nevertheless, growth in consumer spending is expected to be moderated by several headwinds, which have led to consumer confidence falling to low levels in recent months. High inflation is weighing on real incomes, while rising interest rates are also putting downward pressure on disposable incomes. Declining asset prices may also cause consumers to become more risk-averse and reduce discretionary spending.

Dwelling investment has become somewhat constrained due to labour shortages and as pandemic-induced supply chain disruptions led to materials shortages. These also led to rising input costs for the construction sector. This year dwelling investment is expected to grow modestly.

Capacity constraints are expected to gradually ease, which, alongside a large pipeline of construction work, should continue to support activity in the near term. However, rising interest rates are expected to dampen demand for new housing and construction activity, particularly from the second half of 2023.

Business investment is forecast to growing at a high rate through 2023, boosted by a large pipeline of engineering and non-residential building construction projects.

Public demand has been a key driver of Victoria’s economic growth since the onset of the pandemic and is forecast to be broadly unchanged this year, underpinned by the government’s pipeline of transport and social infrastructure projects.

Victoria’s population is estimated to have grown by 1.0% in the year to June 2022, with population growth forecast to rise to 1.4% this year as net overseas and net interstate migration recover further. Population growth is expected to return to the long-term trend of 1.7% from 2024 onwards.

Copyright © 2023 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.