Q4 2023 – Australian Economic Outlook

February 1st 2024 | , Urban Property Australia

- The Australian economy expected to moderate the first half of 2024 however the ongoing recovery in the international student and tourism sectors are helping to support growth;

The Australian economy has slowed in expected ways in the face of global uncertainty, higher interest rates and high but moderating inflation. However, the economy faces these challenges from a position of strength. The labour market remains strong, with over 600,000 additional people employed over the past 18 months and participation is still at close to record high levels. The unemployment rate has recorded its longest consecutive run below 4% in 30 years and wages are growing at the fastest rate in over a decade.

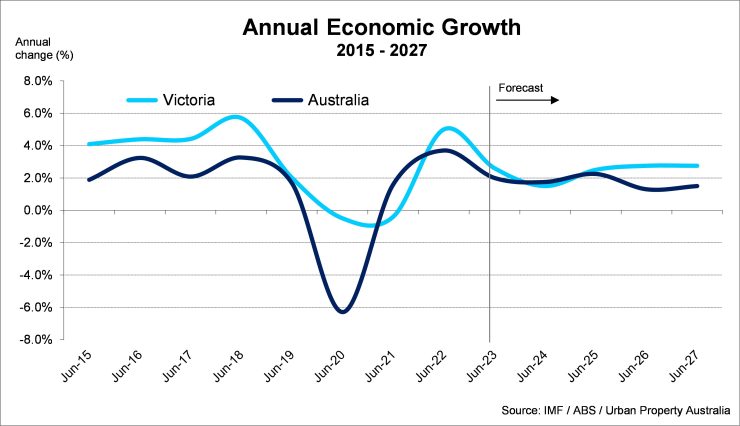

Economic growth is expected to moderate the first half of 2024 as inflationary pressures and higher interest rates weigh on household consumption and dwelling investment. Continued public and business investment momentum and the ongoing recovery in the international student and tourism sectors are helping to offset this weakness and support growth in the first half of 2024.

Economic growth is expected to pick up from late 2024 as inflation subsides following its peak in 2022 and household disposable incomes improve. With inflation moderating, real annual wage growth is expected to return in early 2024. This will support household consumption and drive the pace of economic growth to a forecast 2.5% in the year to June 2025.

The labour market remains resilient, with unemployment below 4% and the participation rate near record highs, including for women. While leading indicators suggest some slowing is underway, consistent with the expected softening in growth, the labour market is forecast to perform well compared to pre-pandemic averages even as momentum eases. Looking ahead, the unemployment rate is expected to rise modestly to 4.25% by June 2024.

Household budgets remain under pressure from elevated but moderating inflation and higher interest rates. Growth in household consumption has softened in recent quarters. Many households, particularly those facing higher housing costs, have adjusted their consumption and savings behaviour. Financial markets and market economists see the current cash rate of 4.35% as at or near its peak.

The near-term weakness in the household sector is being partly offset by stronger-than-expected business investment and a recovery in tourism and international education enabled by the reopening of international borders.

Last year, new business investment grew by 8.2%, the fastest rate since 2012, supported by continued investment in non-dwelling construction projects and demand for new machinery and equipment. The level of business investment is expected to remain elevated through the next two years, though the pace of growth is expected to fall back from recent highs. This activity will be underpinned by a solid pipeline of non-dwelling construction projects, particularly on commercial buildings, electricity transmission, generation and supply, and a few significant LNG projects.

Copyright © 2024 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.