Q4 2023 – Global Economic Outlook

February 1st 2024 | , Urban Property Australia

- Global growth is expected to slow from 3.4% in 2022 to 3.0% in 2023 and 2024 as persistent inflation and higher interest rates weigh on economic activity;

Economic Summary

The outlook for the global economy remains uncertain and inflation is still a key challenge in many economies. Global growth is expected to slow from 3.4% in 2022 to 3.0% in 2023 and 2024 as persistent inflation and higher interest rates weigh on economic activity. The Australian economy has slowed in expected ways in the face of global uncertainty, higher interest rates and high but moderating inflation. However, the Australian economy faces these challenges from a position of strength. Economic growth is expected to pick up from late 2024 as inflation subsides following its peak in 2022 and household disposable incomes improve.

Global Economic Outlook

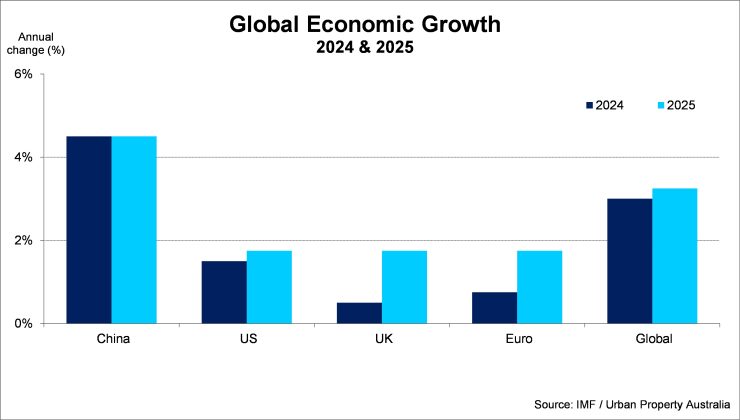

The outlook for the global economy remains uncertain and inflation is still a key challenge in many economies. Russia’s invasion of Ukraine, the Hamas-Israel conflict, China’s property sector downturn and the lagged effects of sharp monetary tightening all pose downside risks to the outlook for global growth. Global growth is expected to slow from 3.4% in 2022 to 3.0% in 2023 and 2024 as persistent inflation and higher interest rates weigh on economic activity. A modest pick-up to 3.25% is expected in 2025.

Key economies have diverged over 2023. The outlook for the euro area and United Kingdom remains weak, given higher peaks in headline inflation and weaker external demand. China’s rebound after the removal of pandemic restrictions has also been more subdued than expected.

In contrast, activity in some advanced economies – particularly the United States – has been stronger than previously expected. Growth has remained resilient despite sharp rises in interest rates over the past two years, labour markets have remained tight and banking sector stresses have so far been successfully contained.

Copyright © 2024 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.