Q4 2023 – Melbourne Office Market

February 1st 2024 | , Urban Property Australia

- More than $800 million of office property was transacted within the Melbourne’s metropolitan office market over 2023, accounting for 60% of all of Melbourne’s office sales over the year;

- Tenant enquiry remains fickle, however office occupancy levels remain significantly below pre-COVID levels, with tenant demand focused on A-grade space;

- The Melbourne CBD office vacancy has continued to rise, increasing its highest level since 1997 with the vacancy rate of the St Kilda Road office market rising to an all-time high.

Office Market Summary

Investment activity within the Melbourne’s metropolitan office market has been relatively resilient with more than $880 million transacted over 2023, accounting for 60% of all of Melbourne’s office sales (inclusive of the CBD), its highest proportion in 20 years. There is more than 160,000sqm of new office projects currently under construction in the metropolitan office market with much of the focus of the new development remains focused on the City Fringe. The Melbourne CBD office vacancy has continued to rise, increasing to 15.0%, its highest level since July 1997. Outside of the CBD, the vacancy rate of the St Kilda Road office market rose to 25.5%, an all-time high.

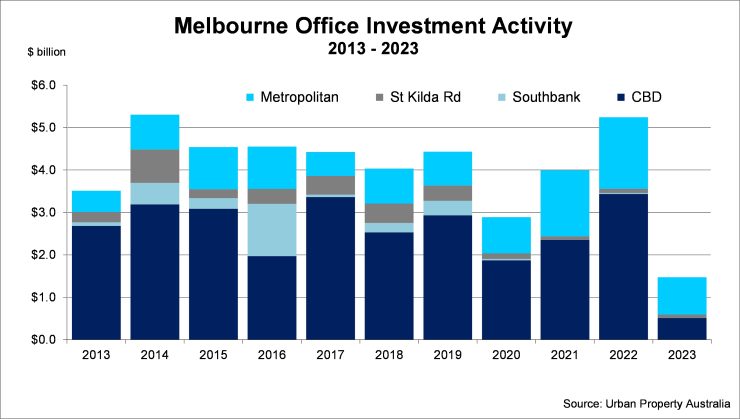

Sales Volume/Yields

While investors remain wary about the office sector, investment activity within the Melbourne’s metropolitan office market has been relatively resilient with $880 million transacted in the market over 2023, higher than its annual average of $700 million. The level of investor interest in the Melbourne’s metropolitan office is further highlighted with the fact that the sector has accounted for 60% of all of Melbourne’s office sales (inclusive of the CBD), its highest proportion in 20 years. Investment volume in Melbourne’s metropolitan office in 2023 was boosted by a number of major transactions with three office sales exceeding $100 million. Given the increased uncertainty, prime metropolitan office yields have continued to ease and now average 7.25% with secondary yields averaging 8.5%. While Urban Property expects investor interest for prime assets with solid income profiles to remain robust, the yield spread between secondary assets is likely to continue to widen as investors become more discerning.

Supply

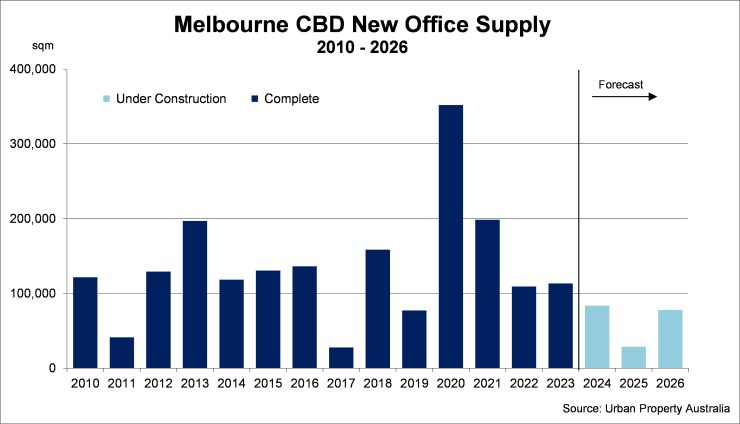

Urban Property is currently tracking 160,000sqm of new office projects currently under construction in the metropolitan office market. Of all the total stock currently under construction in the metropolitan office market, 42% is already committed. Much of the focus of the new development remains focused on the City Fringe with the precinct accounting for 51% of all new metropolitan office stock projected to be completed in 2024 and 2025. With tenant demand strengthening and the level of new supply peaking in the Melbourne metropolitan office market in the short term, Urban Property projects that the vacancy rate has peaked and will trend down as tenants capitalise on the attractive leasing terms on offer to upgrade their office accommodation. Although the vacancy rate is anticipated to have peaked, with vacancy levels still elevated; looking ahead, the development pipeline is forecast to slow as funding requirements for new projects will constrain new supply for the medium term.

Tenant Demand

Over 2023, Victoria’s total employment has increased by 124,000, however the state’s unemployment rate rose to 4.0% as at December 2023, down from 3.5% as at December 2022. A similar trend was observed in the job market with 61,600 jobs advertised in Victoria as at December 2023, down from 71,700 a year earlier, albeit current levels remains above the 10-year average of 47,000. Tenant enquiry remains fickle, however and leasing activity appears to be improving. While employment growth has been solid over the past year, office occupancy levels remain significantly below pre-COVID levels, albeit pleasingly levels have also recovered in the past six months. While tenant demand has been positive over the past 12 months, take up of stock remains subdued with occupiers focused on A-grade space.

Vacancy/Rents

While the level of tenant demand improved, it was surpassed by the level of new completions and as such the vacancy rate of the Melbourne metropolitan office market rose slightly, increasing to 12.5% as at June 2023, still almost double the long-term average. Urban Property forecast that the vacancy rate of the metropolitan office market has peaked for the short term as the pipeline of new supply reduces in coming years. Reflecting the stabilising vacancy levels and improving leasing activity across the Melbourne metropolitan office market, prime rents continue to rise with both growth in net face rental levels while incentive levels stabilise. Looking ahead, Urban Property Australia forecasts that prime rents will modestly rise as tenant demand gathers momentum. In contrast, secondary office rents are projected to decline even more as occupiers seek to capitalise on better quality space which is highlighted from the recent trend of tenant moves.

CBD, St Kilda Road & Southbank Office Markets

The total Melbourne CBD office vacancy has continued to rise, increasing to 15.0% as at July 2023, its highest level since July 1997. As occupiers continue to re-assess their CBD office requirements, sub-lease vacancy levels rose through 2023 with now more than 100,000 square metres across the CBD offered for sub-lease with Urban Property Australia projecting further rises in 2024. Tenant demand in the CBD office market over the first half of 2023 was negative, with most occupation levels of most grades contracting, surprisingly led by A-grade office stock. As a result of the tenant vacations, the A-grade office vacancy rate in the CBD has increased to 15.2% – its highest level since 1995. Net effective rents for Melbourne CBD office stock have declined as incentives has risen in response to increasing vacancy rates and subdued tenant demand. Constrained by limited purchaser sentiment and the elevated vacancy rate, sales activity in the CBD recorded the lowest level of sales volume in 20 years with $510 million transacted in 2023.

Outside of the CBD, the vacancy rate of the Southbank office market rose to 18.3% as at July 2023, its highest rate since January 1995. Elsewhere the vacancy rate of the St Kilda Road office market rose to 25.5% as at July 2023, an all-time high. Although the vacancy rates of both the St Kilda Road and Southbank’s office markets are elevated; Urban Property Australia anticipates the addition the Anzac railway station in 2025 and the rejuvenation project of Southbank Boulevard will stimulate tenant demand for both markets in the medium term. Similar to Melbourne’s other office markets, transactional activity remains subdued in both Southbank and St Kilda Road office markets with less than $100 million transacted across the two office markets in 2023 compared with the long-term annual average of $500 million.

Copyright © 2024 by Urban Property Australia All rights reserved. No part of this publication may be reproduced in any form, by microfilm, xerography, electronically or otherwise, or incorporated into any information retrieval system, without the written permission of the copyright owner.